KRYSTAL VENTURES STUDIO envisions an eco-system to facilitate startup growth and development and find investors to partner with & move their business from good to great.

- Sree Gururaya Mansion, No. 759, 3rd Floor, 8th Main Rd, 3rd Phase, J. P. Nagar, Bengaluru, Karnataka 560078

- info@krystalvs.com

Fueling Investment For Tomorrow's Innovations

A Tech-based Cohort by

Tech-Based Cohort

An Overview

In the global economic spotlight, India is poised for remarkable growth by 2030, with a forecasted GDP of USD 8 Trillion and per capita income of $5,625.

This digital revolution, driven by affordable high-speed internet, is creating a vast market, inviting internet-based businesses to thrive.

With over 100,000 startups and India’s youthful, tech-savvy workforce, the already thriving and vibrant Indian economy looks promising in future too.

Krystal Ventures Studio capitalizes on this fertile ground, connecting visionaries and investors in India’s tech-driven future.

FinTech

- Payments

- Lending Tech

- Investment Tech

- Insurance Tech

- Neobanking

- Fintech SaaS

- Embedded Finance

HealthTech

- Telemedicine

- Online Pharmacy

- Fitness & Wellness

- Healthcare SaaS

DIVERSIFIED, THEMATIC & RISK MITIGATED

With an objective of bridging the gap between visionary startups and passionate investors, Krystal Ventures Studio aims to create a diversified, thematic, and risk mitigated tech-based cohort.

To drive growth for startups and keeping in mind the diverse investment preferences, our commitment extends to key sectors with boundless potential:

FinTech Startups

HealthTech Startups

SUCCESS DRIVERS FOR TECH-BASED STARTUPS

HealthTech

Transformation

HealthTech startups drive healthcare innovation, enhancing patient care and outcomes.

Demography

Ageing populations create a vast market for HealthTech solutions.

Data Dependency

HealthTech uses data and AI for personalized healthcare.

FinTech

Financial Inclusion

FinTech fosters financial inclusion for underserved populations.

Digital Banking Disruption

Digital banks revolutionize traditional banking, attracting investors.

Risk Management and Security

FinTech pioneers advanced risk and security solutions for the digital financial world.

MARKET OPPORTUNITY

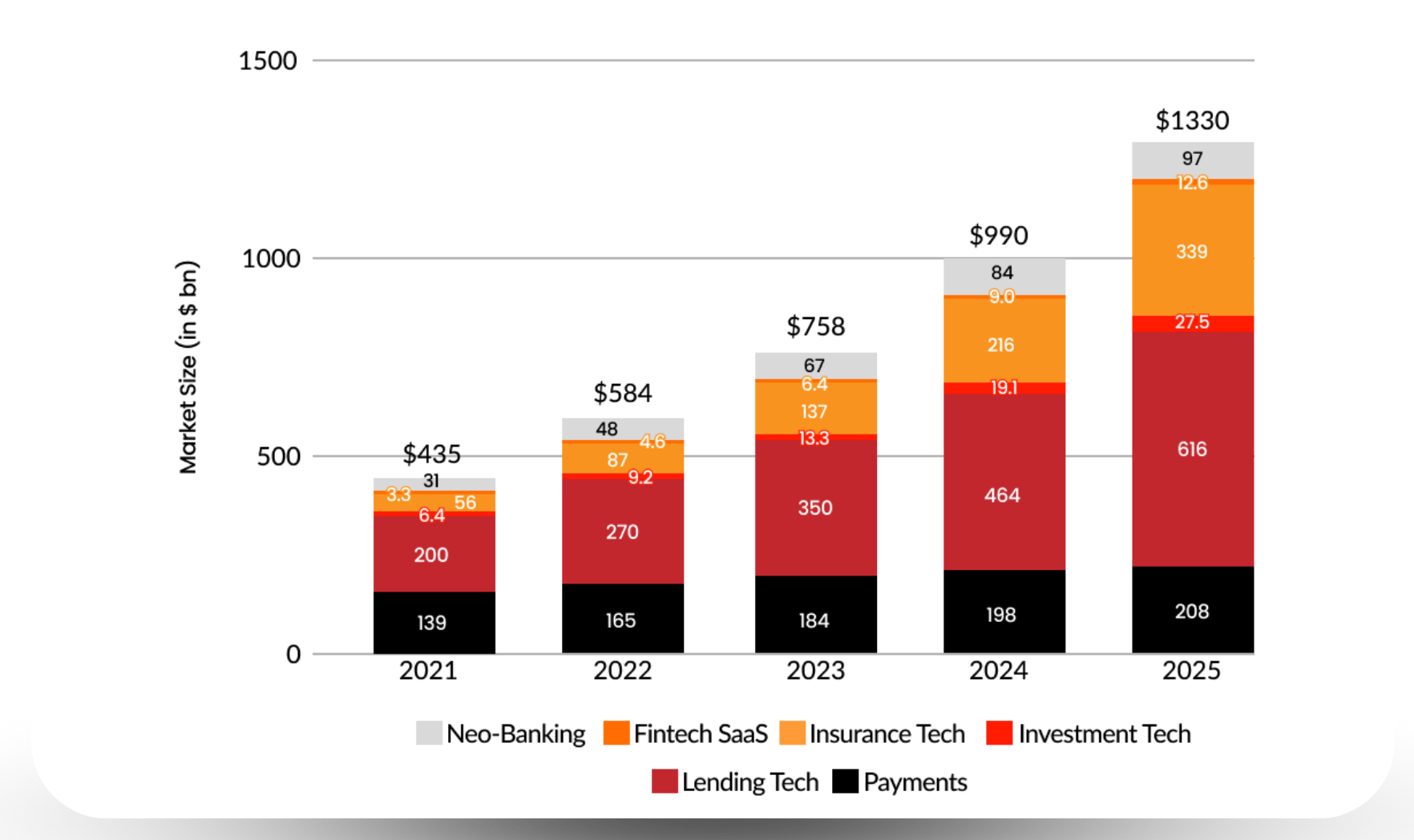

- India’s FinTech space is 2nd largest funded sector in Q1 2023, after US

- Indian FinTech Market is estimated to reach $1 Tn by 2025

- Key Growth Areas: Neobanking, Fintech SaaS, Insurance Tech, Investment Tech, Lending Tech, and Payments.

- Emerging Sector: Buy-Now-Pay-Later (BNPL)

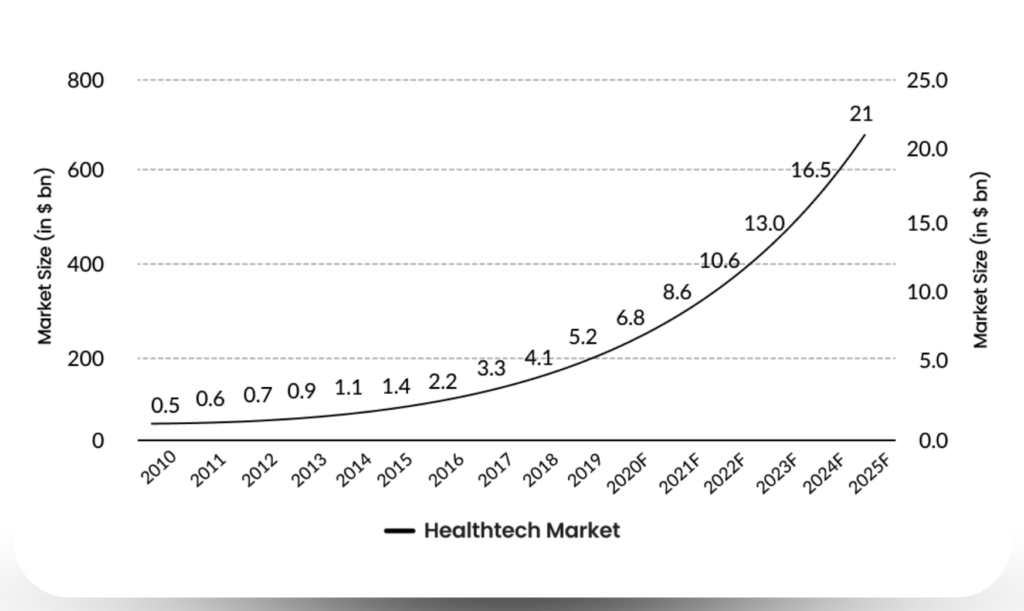

- India’s HealthTech Market holds $21Bn opportunity

- Expected to reach $50 Bn by 2030

- Key Growth Areas: Telemedicine, E-pharmacy, Fitness, Wellness, Healthcare IT

- Emerging Sector: Health Wearables, Web-3 based Healthcare Marketplaces

GOALS AND OBJECTIVES

INVESTMENT STRATEGY

Emerging Sectors Focus

- We invest in early-stage businesses at the forefront of emerging tech-based sectors and Generative AI based products in Health and Finance, specializing in both products and services.

EXIT STRATEGY

- Target a favorable exit within three years.

- Portfolio startups should have a clear path to substantial market share.

- Identify potential acquirers or public markets interested in these startups.

Investment Thesis

Our investment thesis seeks to pinpoint six(6) standout startups three(3) each in HealthTech and Fintech.

Key Company Indicators to be considered for investment

- Potential and Clear Path to Success

- Strong Unit Economics

- Experienced Team with a track record in the B2B segments.

- Product Market Fit with tangible traction.

Investments in two tranches

Target Business Stage

- Seed stage to early stage Investments First Institutional Investment Visibility of second round of investments from Exit partners

GOALS AND OBJECTIVES

INVESTMENT STRATEGY

Emerging Sectors Focus

- We invest in early-stage businesses at the forefront of emerging tech-based sectors and Generative AI based products in Health and Finance, specializing in both products and services.

Key Company Indicators to be considered for investment

- Potential and Clear Path to Success

- Strong Unit Economics

- Experienced Team with a track record in the B2B segments.

- Product Market Fit with tangible traction.

- Financial Viability: A revenue run-rate between 10 Lakhs to 1 Crore.

- Impressive Growth rate of 40%+ CAGR.

Investment Thesis

Our investment thesis seeks to pinpoint six(6) standout startups three(3) each in HealthTech and Fintech.

DEAL SIZE

INR 1 crore in 6 Investee companies as Minority stake investments.

Investments in two tranches

Target Business Stage

- Seed stage to early stage Investments First Institutional Investment Visibility of second round of investments from Exit partners

EXIT STRATEGY

- Target a favorable exit within three years.

- Portfolio startups should have a clear path to substantial market share.

- Identify potential acquirers or public markets interested in these startups.

RISK & MITIGATION STRATEGY

Founder’s Risk

- Evaluating the founders’ experience, track record, and certificates.

Returns & Exit Risks

- Ensuring expected returns are met with portfolio diversification.

- Evaluating profitability and future capital requirements.

- Understanding the exit strategy and likelihood of successful exits.

Market & Product Risk

- Assessing business model, product scalability, market potential, and competition.

- In-depth market research, GTM strategy, and competitive advantage assessment.

Financial & Regulatory Risks

- Analyzing the startup’s balance sheet, debt-equity ratio, and cash flow.

- Ensuring regulatory compliance and a strong legal and compliance team.

Front Office Program

- Portfolio basket or cohort

- Selection criteria

- Shortlisting

- Discovery-wants & needs

- Mandate

Werden Advisory Program

- Portfolio basket or cohort

- Milestones & critical path items

- Market access & technology roadmap

- Global footprint program

Investor Program

- Developing blind capital pools

- Fundraise for portfolio from capital pools

- Investor relationships

- Co-investors and portfolio creation

- Startup as an asset class

Exit Program

- Developing blind capital pools

- Fundraise for portfolio from capital pools

- Second round of investments

- Venture capital/secondary

- Listing and STOS

- Startups exit

TEAM

Ashok Subramanian

Ashok Subramanian is Managing Partner in Krystal Ventures Studio. He is a Serial Entrepreneur, Technology Evangelist and Business Strategist. He has experience in Private Equity, Mergers & Acquisitions and Structured Finance. He has more than 28 years of experience in management, go-to-marketing, and business operations (managing P&Ls) in Wipro and Reuters. He is an Alumnus of IIM Calcutta and Madurai Kamaraj University.

Shrihari A

Shrihari A, Director, Krystal Ventures Studio, is an Investment Banking Specialist. Shrihari leads venture capital fund and startup initiatives and leads the Strategic Holdings. He has more than 28 years of work experience in managing HNI funds, raising capital resources through Private Equity, Venture Capital, ECB and financial institutions. He is an Alumnus of IISc, Bangalore, Mangalore University and IGNOU.

Rattandeep Singh

Rattandeep is Director in Krystal Ventures Studio. He has rich experience in Financial Services Advisory Business ranging from Direct equity to Third- party structured products. He has worked in investment management, finance, sales and Brand strategy at reputed cos. like Motilal Oswal, Karvy and IL& FS Investsmart. By education, He has an MBA from T A Pai Management Institute and a graduate degree in Economics from Delhi University.

Jasmine Bharucha

Jasmine Bharucha is a dynamic professional with a rich and diverse career spanning over 15 years in IT outsourcing, Jasmine's journey through corporate giants like KPMG and Capgemini has been nothing short of extraordinary. What sets Jasmine apart? Her entrepreneurial spirit! In 2019, she founded Katharos Foods, showcasing not just business prowess but also a commitment to sustainable and healthier plant based food choices by introducing the World’s first plant based cheese made from Watermelon seeds!

Start your journey towards a sustainable future for people and the planet.

Join Our Tech-based Startups Cohort to seek investments

Get access to our global community of investors and open doors to the right mentorship.