Menu

KRYSTAL VENTURES STUDIO envisions an eco-system to facilitate startup growth and development and find investors to partner with & move their business from good to great.

Our Location

- Sree Gururaya Mansion, No. 759, 3rd Floor, 8th Main Rd, 3rd Phase, J. P. Nagar, Bengaluru, Karnataka 560078

- info@krystalvs.com

Copyright © Krystal Ventures 2023. All rights reserved.

Who we Are

KVS UAE

KVS UAE is a platform connecting startup needs and investor interests. We curate risk- mitigated startups, creating thematic portfolios for the MENA region with UAE as the focal point.

Vision/Mission

To transform MENA startups into an asset class and offer investors a ring-side view of the startup world. We envision to drive economic growth in the UAE and GCC ecosystem, fostering collaboration with peers in the Global South (KVS-IND, KVS- UAE, and KVS-SGP).

Our Motto

Success With Clarity

We bring qualitative and quantitative parameters in our approach for investor and startup-friendly outcomes in terms of exits, returns, and scalability of business models.

Timely support for startups with market-proven ideas

Reducing ambiguity in startups as an asset class

Creating an ecosystem for great outcomes

Gateway to MENA (&) Global South

UAE is transforming from a regional heavyweight to global startup hotspot.

Startup Ecosystem At A Glance

In 2020, there were 35K active tech startups, with 80% concentrated in Dubai and Abu Dhabi.

The region saw 149 startup deals securing a disclosed funding of $1.08 billion, representing 26% of all startup deals in the MENA region.

Poised For Growth

Startups founded in 2020 increased by 38% compared to 2019, with a 32% rise in tech startups.

Tech startups raised $703 million in funding in 2020, reflecting a significant 33% increase.

Increasing Investor Appetite

MENA region attracted a $3.2 billion funding boost, marking an 8% growth from the previous year

Mega deals (over $5 million) increased by 133%, reaching a total of 7 deals, while exits saw a notable 71% annual increase

Why Emirates?

Let’s find out why Emirates is the most conducive ecosystem for startups and investors in the MENA region right now.

High Demand

Over 450 million individuals seeking innovative products and services.

With over 80% smartphone penetration, tech-savvy consumers are fueling the growth of unique direct-to-consumer (D2C) brands.

Reciprocating Value

eCommerce startups accounted for 14% of the deals in 2020.

The top 10 MENA Unicorns have a combined valuation exceeding $66 billion.

Supporting Mechanisms & Resources

Government initiatives provide funding, mentorship, and regulatory support for entrepreneurship.

Strong VC ecosystem with reliable incubators and accelerators.

Attractive visa and business policies to attract global talent.

Explore Opportunities

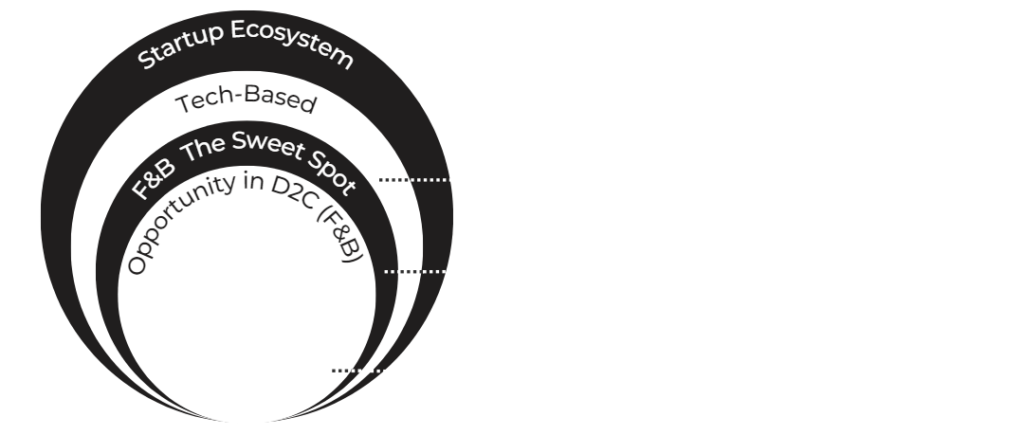

TRENDS TO LOOK OUT FOR

The F&B sector dominated MENA funding in Q1 ’21.

53% of F&B funding went to UAE-based ventures.

The average ticket size for MENA F&B was $5.5M in Q1 ’21.

Foodics (KSA) and iKcon (UAE) secured a significant F&B deal worth $20M.

Q1 2021 had 13 transactions, indicating a healthy pipeline of F&B startups.

Our fund drives growth for early to mid-cap companies in strategic sectors.

Future Roadmap For $100 MM+ Fund

We focus on disruptive themes like Food and Beverage Brands, Food and Agri tech, Fintech and Health tech, and Climate and ESG tech, providing attractive opportunities and returns for Middle Eastern investors.

1st Phase

Establish Foundation and Strategic Partnerships

2nd Phase

Fund Formation and Structure

3rd Phase

Fundraising and Investor Engagement

4th Phase

Active Investment Phase

How KVS UAE Will Drive Value for the Stakeholders?

Through our research analysis and our experience in creating thematic portfolios we will identify risk-mitigated opportunities to build Startup as an Asset Class for our stakeholders.

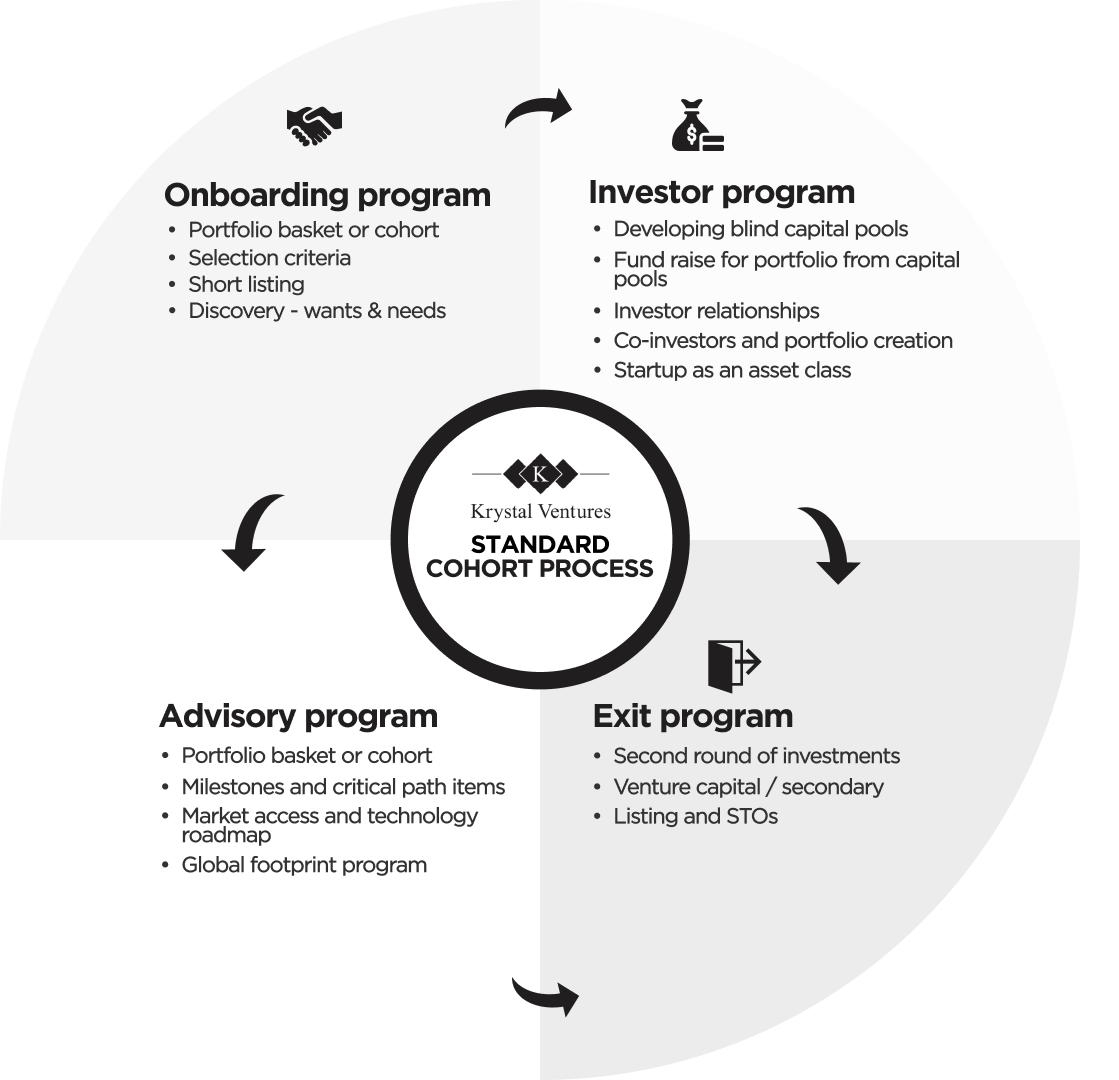

Strategic Cohort Development with Custom & Captive Cohorts

Thematic Portfolio Alignment

Custom Cohorts

Captive Cohorts

Ecosystem & Investors Alignment

Fund Source Collaboration

Investor Pool Funding

Independent Investment Committee

Strategic Exits

Exit Visibility

TEAM

Ashok Subramanian

Ashok Subramanian is Managing Partner in Krystal Ventures Studio. He is a Serial Entrepreneur, Technology Evangelist and Business Strategist. He has experience in Private Equity, Mergers & Acquisitions and Structured Finance. He has more than 28 years of experience in management, go-to-marketing, and business operations (managing P&Ls) in Wipro and Reuters. He is an Alumnus of IIM Calcutta and Madurai Kamaraj University.

Rattandeep Singh

Rattandeep is Director in Krystal Ventures Studio. He has rich experience in Financial Services Advisory Business ranging from Direct equity to Third- party structured products. He has worked in investment management, finance, sales and Brand strategy at reputed cos. like Motilal Oswal, Karvy and IL& FS Investsmart. By education, He has an MBA from T A Pai Management Institute and a graduate degree in Economics from Delhi University.

Jasmine Bharucha

Jasmine Bharucha is a dynamic professional with a rich and diverse career spanning over 15 years in IT outsourcing, Jasmine's journey through corporate giants like KPMG and Capgemini has been nothing short of extraordinary. What sets Jasmine apart? Her entrepreneurial spirit! In 2019, she founded Katharos Foods, showcasing not just business prowess but also a commitment to sustainable and healthier plant based food choices by introducing the World’s first plant based cheese made from Watermelon seeds!

Shrihari A

Shrihari A, Director, Krystal Ventures Studio, is an Investment Banking Specialist. Shrihari leads venture capital fund and startup initiatives and leads the Strategic Holdings. He has more than 28 years of work experience in managing HNI funds, raising capital resources through Private Equity, Venture Capital, ECB and financial institutions. He is an Alumnus of IISc, Bangalore, Mangalore University and IGNOU.

TRIBLOOM

A Global South Advisory Initiative

Contact Us

We are available online and over call. Fill out this form below and we will get back to you.