In recent years, India has witnessed a remarkable transformation in its financial technology landscape. The advent of UPI (Unified Payments Interface) has revolutionized the way payments are made in the country. Behind this revolutionary shift lies the foundation of India Stack, a digital infrastructure that has enabled seamless and secure transactions. In this blog post, we will explore the different layers of India Stack and understand how it has transformed UPI payments in India.

What is India Stack?

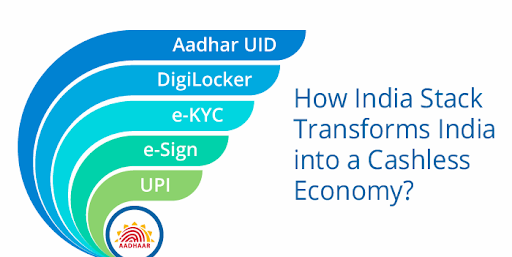

India Stack is a digital infrastructure that empowers the government, businesses, and citizens to securely authenticate and share information electronically. It is a set of open APIs (Application Programming Interfaces) that enable the building of a robust digital ecosystem. At its core, India Stack aims to provide a secure and scalable platform for digital transactions, making financial services accessible to all.

The Layers of India Stack:

- Aadhaar: At the base of India Stack lies Aadhaar, a unique identification system that assigns a 12-digit biometric-based number to every Indian resident. Aadhaar authentication allows individuals to securely verify their identity, making it the foundation for various digital services.

- Digital Locker: Another crucial layer of India Stack is the Digital Locker, which provides individuals with a secure digital space to store and share their personal documents. This eliminates the need for physical copies and enables easy access to important documents like educational certificates, passports, and more.

- e-KYC: Electronic Know Your Customer (e-KYC) allows businesses to verify customers’ identities quickly through Aadhaar-based authentication. This layer eliminates the need for physical documents and allows for a seamless onboarding process.

- e-Sign: e-Signature, or e-Sign, is a layer that allows individuals to digitally sign documents, making them legally binding. This feature eliminates the need for physical signatures, reducing paperwork and making transactions more efficient.

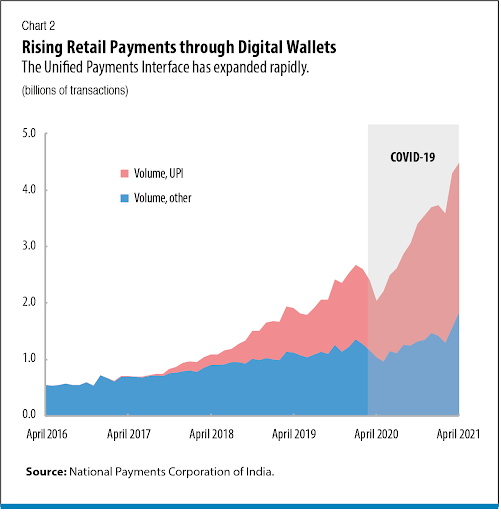

- Unified Payments Interface (UPI): UPI is the layer that has truly transformed the payments landscape in India. It allows users to instantly transfer funds between bank accounts using their smartphones. UPI integrates seamlessly with various payment systems, enabling secure, real-time transactions 24/7.

Revolutionizing UPI Payments:

India Stack has played a pivotal role in revolutionizing UPI payments in India. By leveraging the different layers of India Stack, UPI has become a game-changer in the fintech industry. Here’s how India Stack has transformed UPI payments:

- Seamless Integration: India Stack’s APIs have made it possible for UPI to integrate with various banking and financial systems effortlessly. This has enabled users to link their bank accounts to UPI platforms, making transactions faster and more convenient.

- Accessibility: With the widespread adoption of smartphones, UPI has become accessible to a large section of the Indian population. The simplicity of UPI transactions, coupled with the secure infrastructure provided by India Stack, has made digital payments accessible to both urban and rural areas.

- Security: India Stack’s robust security framework ensures that UPI transactions are safe and secure. Aadhaar-based authentication, e-KYC, and digital signatures provide multiple layers of security, reducing the risk of fraud and unauthorized access.

- Financial Inclusion: One of the key benefits of UPI powered by India Stack is its ability to drive financial inclusion. With UPI, individuals who previously didn’t have access to traditional banking services can now transact digitally, empowering them to participate in the formal economy.

India Stack has been instrumental in revolutionizing UPI payments in India. By providing a secure and scalable digital infrastructure, India Stack has enabled UPI to become a powerful tool for financial inclusion and digital transformation. With its seamless integration, accessibility, and emphasis on security, India Stack has laid the foundation for a vibrant and thriving fintech ecosystem in India. As UPI continues to gain momentum, it promises to reshape the way transactions are conducted, making India a frontrunner in the digital payments revolution.